Home Sweet Home: To Rent or To Own? Exploring the Pros and Cons

Home Sweet Home: To Rent or To Own? Exploring the Pros and Cons

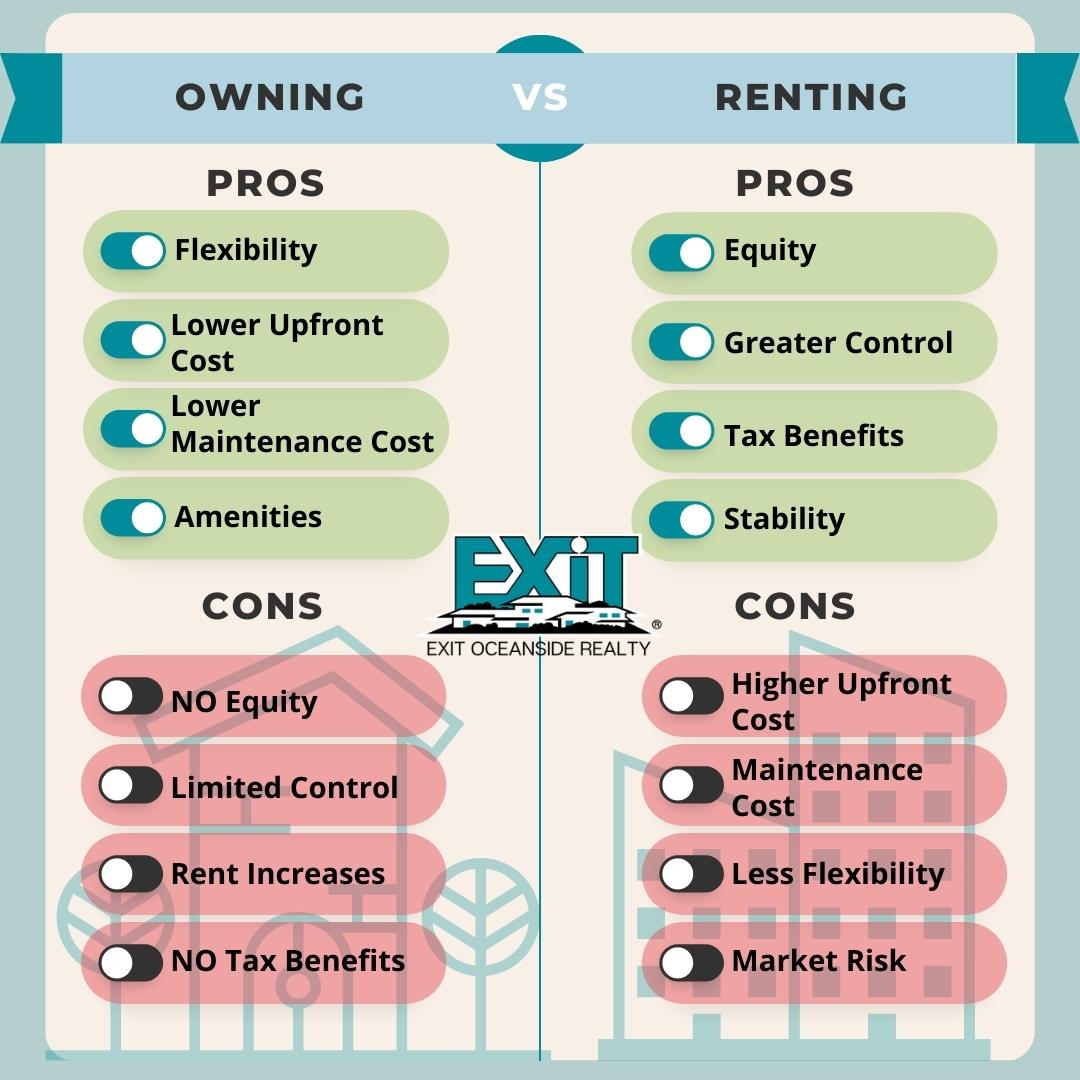

When it comes to choosing where to live, one of the most significant decisions you'll have to make is whether to rent or own a home. Both options have their advantages and disadvantages, so it's important to weigh them carefully before making a decision.

Pros of Renting:

Flexibility: Renting provides greater flexibility in terms of being able to move whenever you want. This is especially useful if you are someone who needs to move frequently due to a job or personal reasons.

Lower Upfront Costs: Renting a property typically requires lower upfront costs than owning a home. You may only need to pay a security deposit, the first and last month's rent, and utility deposits.

Lower Maintenance Costs: As a renter, you are not responsible for repairs and maintenance of the property, which can save you money in the long run.

Amenities: Many rental properties offer amenities such as a pool, fitness center, or clubhouse, which can add to your quality of life without any additional expense.

Cons of Renting:

No Equity: When you rent a property, you are not building equity, which means you are not investing in your future.

Limited Control: As a renter, you have limited control over the property. You cannot make major changes or improvements to the property without the landlord's permission.

Rent Increases: Rent increases are a common occurrence, and you may find yourself facing higher rents every year, making it difficult to budget and plan for the future.

No Tax Benefits: You cannot claim tax benefits such as mortgage interest deductions or property tax deductions when you rent.

Pros of Owning:

Equity: When you own a home, you are building equity, which means you are investing in your future.

Greater Control: You have complete control over the property and can make changes and improvements as you see fit.

Tax Benefits: You can claim tax benefits such as mortgage interest deductions or property tax deductions when you own a home.

Stability: Owning a home provides greater stability and can give you a sense of permanence and security.

Cons of Owning:

Higher Upfront Costs: Buying a home requires a significant upfront investment, including a down payment, closing costs, and other expenses.

Maintenance Costs: As a homeowner, you are responsible for all repairs and maintenance of the property, which can be expensive.

Less Flexibility: Owning a home ties you down to a specific location, making it more difficult to move when you want or need to.

Market Risk: The value of your home can fluctuate based on market conditions, which can affect your investment.

So, which is better - renting or owning a home? Ultimately, it depends on your individual circumstances and priorities. If you value flexibility and don't want the responsibility of home maintenance, renting may be the better option for you. On the other hand, if you're looking for stability and the potential for long-term financial gain, owning a home may be the way to go.

It's important to note that while owning a home can be a wise investment, it's not for everyone. If you're not financially stable or you're not sure if you'll be able to afford the monthly mortgage payments, it may be best to hold off on buying a home until you're in a better position to do so.

Ultimately, whether you choose to rent or own, make sure you do your research and consider all the factors carefully before making a decision.