2022 Real Estate Market Predictions

After the wild ride of the past year in real estate it seems like everyone is holding his breath waiting to see what 2022 has in store. As the new year inches closer more and more economic and housing experts are delivering their predictions for what to expect in the new year.

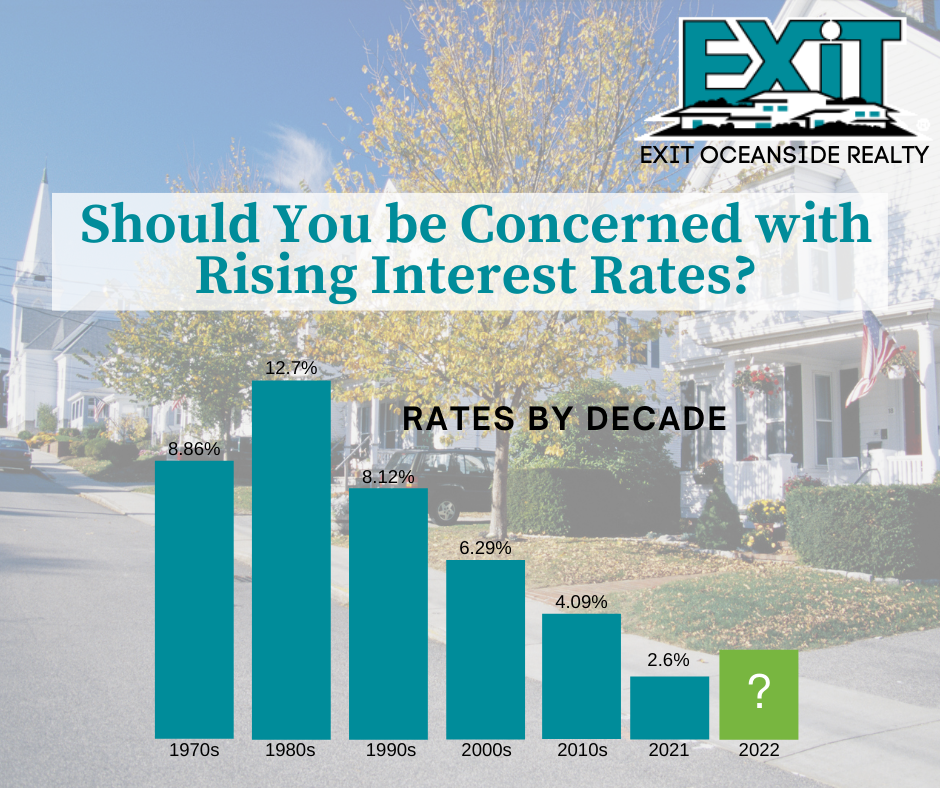

Interest Rates

During the early days of the pandemic, the federal government took action to push mortgage rates to their lowest levels on record. This spurred homebound Americans into “one of the most competitive housing markets in modern history” according to an article published by Fortune magazine on Dec 27, 2021. But all of that is about to change as CNN reports that the Federal Reserve has indicated that it will soon end its pandemic policy in order to curb inflation, which is at a 39 year high. What does this mean for the housing market?

Undoubtedly interest rates will rise, but experts are divided on exactly what that will look like. The Mortgage Bankers Association, an industry trade group, predicts that interest rates will reach 4% in 2022. Fannie Mae is predicting interest rates of 3.3%. Meanwhile, Nik Shah CEO of Home LLC, and experts from the National Association of Realtors both have more moderate predictions. The groups predict interest rates of 4% and 3.7% respectively. When folks consider the pre-pandemic interest rate was 4% many are simply asking, “so what?”

Prices

The “so what” is that higher interest rates combined with a high median sales price will likely price many people out of the market. While interest rates have remained low nationally the price of single-family homes has risen 19.5% in the past year. Here in Maine, the median sales price in York county has risen from $300,000 in November 2019 to $410,000 in November 2021 according to the Maine Association of Realtors. And while the difference in an interest rate of 4% and 3.3% may not seem like a big deal, on a $500,000 30-year-mortgage it would mean an additional $200 a month according to Fortune Magazine.

Again, expert predictions about what home prices will do in 2022 are varied. The Mortgage Bankers Association predicts median home prices will decrease by 2.5%. Fannie Mae predicts an increase of 7.9%. While other experts predict simply that median home prices will continue to rise but at a much more moderate rate. Lawrence Yun, chief economist for the National Association of Realtors told CNN, “Slowing price growth will partly be the consequence of interest rate hikes by the Federal Reserve.”

Inventory

A third crucial aspect of market predictions is the number of homes available for sale. As they look to 2022 experts agree that inventory will continue to impact the market. Shah pointed to supply and demand in his Fortune interview to explain continued price growth despite interest rate hikes. Realtor.com forecasts that home inventory will remain low in 2022, growing by a mere 0.3% and Freddie Mac has estimated that the nation is 4 million homes short of current buyer demand.

Similar patterns can be seen in the local market as well. A sixth-month supply of “For Sale” inventory is considered a balanced market. The Maine Association of Realtors reported Maine had a 2.1-month supply in September of 2021 and a 1.7 month supply in November of 2021. This has contributed to the consistent decrease month to month in the number of homes sold in the state of Maine while home prices have continued to rise.

What Does it All Mean?

Let’s look at the facts. Interest rates will increase but will probably not surpass pre-pandemic levels. Price conditions will most likely stay consistent as long as inventory is scarce. Home Sellers will need to monitor interest rates and be mindful of market conditions when setting their home prices. Home Buyers will need to be patient, consistent, and prepared. Now more than ever a realtor will be the key to keeping track of what the market is doing and how it will impact your real estate decisions.