Understanding Your Credit Score

On my list of things I wish I had learned in school rather than Pi is understanding Credit. There’s a lot of chatter out there about credit scores, but how many of us really understand what it means? And more importantly how many of us truly understand how to use it as a tool to reach our goals. Today on the blog we are answering your credit questions!

First, What is Credit? What is a credit report and why do we care about our credit score?

Credit is the ability to borrow money or access goods or services with the understanding that you'll pay later. Your ability to borrow is based on your history of repayment as detailed in your credit report. Your credit report is a thorough accounting of your credit history, including credit accounts, how often you apply for credit, debt collections, and bankruptcies. Your credit score is a numerical summary of all of these factors.

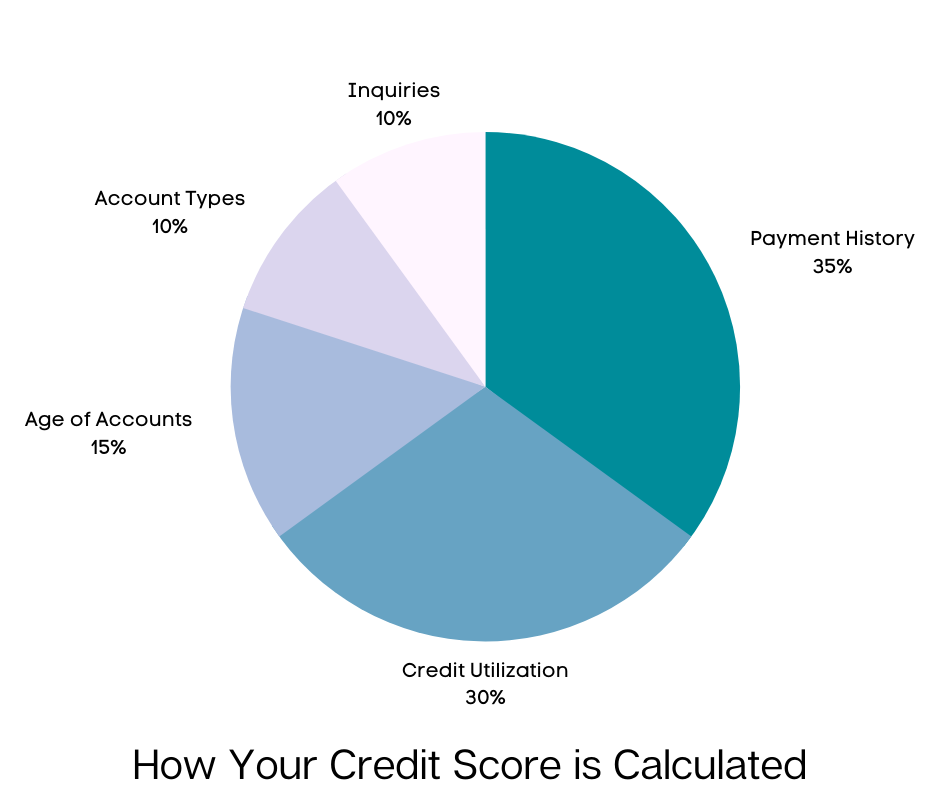

How do they calculate your credit score?

According to credit.com, there are 5 factors that determine your credit score:

- Payment History: 35% of your credit score is impacted by how often you have made late payments.

- Credit Utilization: This factor takes into consideration how much of your available credit you are using and accounts for 30% of your score.

- Age of Credit Accounts: The older your credit accounts are the better since this shows a long-term history of responsible payments. Account Age is 15% of your credit score.

- Account Types: Ten percent of your credit score is based on having a good variety of credit including a few credit cards, car loans, and home loans.

- Inquiries: The final factor is the number of times your credit has been pulled recently. If you are applying for multiple lines of credit at once it makes creditors nervous. This accounts for the final 10% of your credit score.

Who gives you your credit score?

There are 3 credit reporting agencies; Equifax, Experian, and TransUnion. According to USA.gov each credit reporting agency collects and maintains its own records for your credit report. This means that they may not all have the same information and you will likely have a different score from each. The government site states that “even though there are differences between their reports, no agency is more important than the others. And the information each agency has must be accurate.”

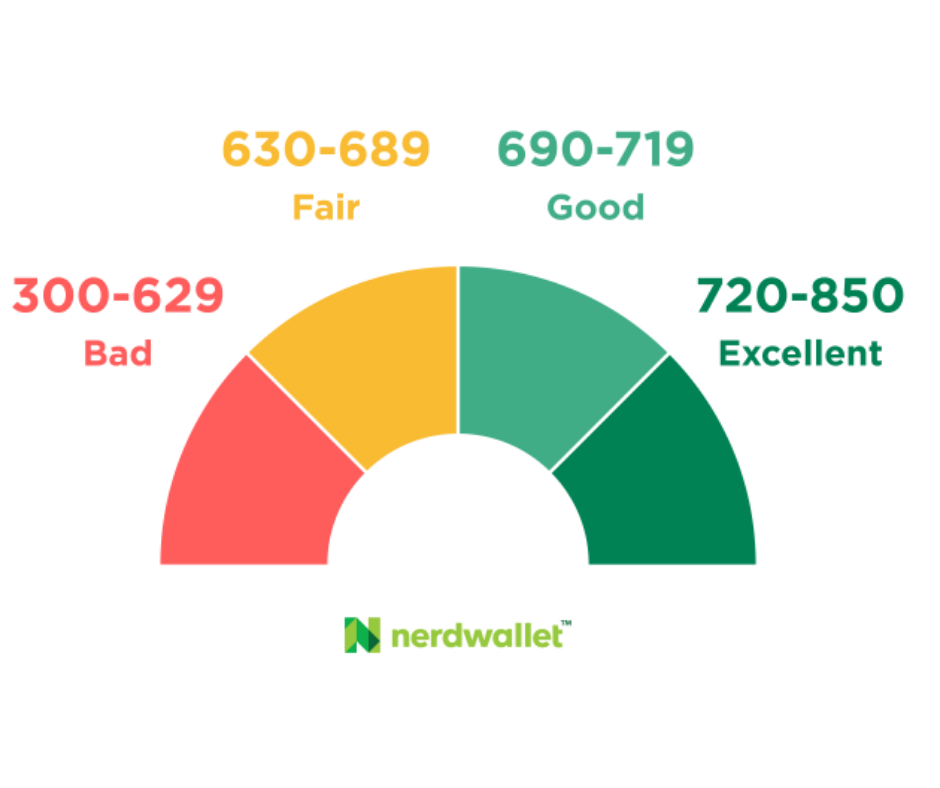

What is considered a good credit score?

According to Creditry while the term “good credit” is subjective it is generally acknowledged that a score around 700 is good. Nerdwallet provides the chart below to help you understand where your score falls. Excellent credit falls in the range of 720 to 850. Good credit falls in the range of 690 to 719. Those with credit between 630 and 689 are considered to have fair credit. While folks with scores under 629 are considered to have poor credit.

If I’m not going to apply for a loan, then my credit score doesn’t matter, right?

Wrong. Even if you aren’t planning to apply for a loan there are lots of other institutions that will check your credit in order to ascertain your trustworthiness. These include; landlords, prospective employers, and utility and cell phone companies. The other thing to keep in mind is that it takes time to build good credit. According to an article by thebalance.com, you’ll need months, even years of positive money habits to prove your creditworthiness. So if you ever want to buy a home or finance a car, what you do with your credit now matters.

How do I improve my credit score?

There are a million suggestions and “proven methods” out there on how to improve your credit “fast”. As far as I can tell improving your credit is a process no matter who you listen to.

The most sensible first step in improving your credit score is to get a copy of your credit report from each of the three credit bureaus. You are entitled to a yearly free credit report from each of the bureaus. Simply go to annualcreditreport.com, a federally mandated site that provides your free annual reports. Keep in mind that while inquiries from creditors will lower your score, checking your own credit will have no negative impact.

Assess your reports by looking at which of the 5 factors that make up your credit score are impacting it negatively. Then take any of the following steps to begin repairing the damage.

- Have anything inaccurate and debts older than 7 years removed from the report.

- Ask a friend or relative to be added as an authorized user on an old account with perfect payment history. You don’t even have to have a card for the account but will become associated with the positive payment history.

- Pay down your accounts to lower your credit utilization percentage. Your credit utilization percentage should be lower than 30%.

- If you don’t have a long credit history you may also consider joining a credit boosting program such as Experian Boost or UltraFICO which according to Investopedia, “collects financial data that isn’t normally in your credit reports, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score.”

- Don’t close old credit accounts. As long as the accounts aren’t delinquent they won’t hurt your credit score but will help lower your credit utilization score and will show a longer credit history.

- If you need to build a positive credit history but can’t get credit, consider getting a secured credit card. These operate similarly to a prepaid credit card where you give the card company a security deposit. You are then given a credit card with a limit equal to your deposit amount. You can use this card just like any other credit card and the monthly on-time payments are reported to the credit bureaus.

How do I know if I have good enough credit to buy a home?

Your home buying journey truly begins years before you are ready to look at homes. We encourage anyone who has buying a home in their 5 or 10-year plans to speak with a reputable lender today. They will be able to give you an honest look at what your current credit score can do for you and help you form a plan for how to improve your buying power. Especially if you have poor credit or no credit this may take several years, so we suggest speaking with a lender sooner, rather than later. We also suggest building a relationship with a Realtor you trust. Even if you are years away from actually purchasing a home they are a wonderful resource for tips on building buying power. And, when the time comes to start looking at homes you will rest assured knowing that your Realtor knows you and has your best interests at heart.

Want to connect with a great Realtor today and start creating your plan for homeownership? Call the EXIT office at 207-646-8333 and we will connect you with someone who fits your needs.